See the

Details

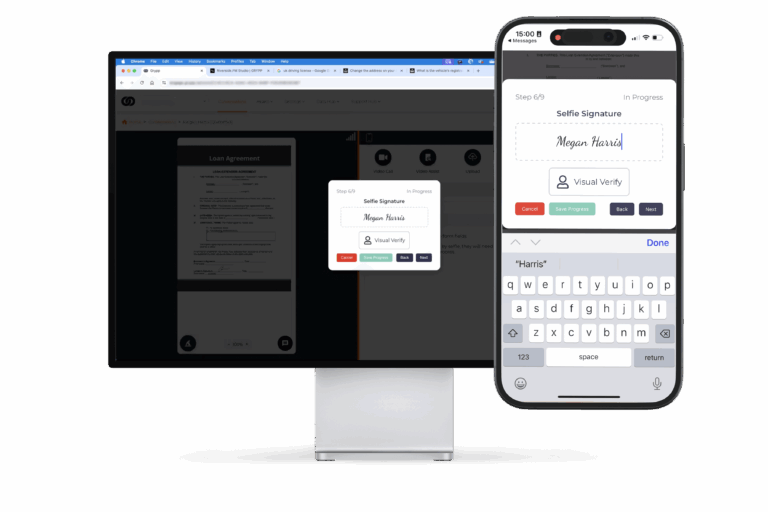

Verify ID and capture signatures in real time

Real time support made more efficient with instant ID verification and digital signatures

What are ID Verification & Digital Signatures?

Secure, real-time and intelligent document signing with live and offline KYC capabilities.

Relying on physical paperwork or asynchronous digital signing platforms to conduct document reviews, signature collection, and identity validation considerably disrupts and delays the flow of customer interactions.

Eliminate disjointed customer workflows and reduce abandonment by completing forms and handling verification live with your customers – together, in real time.

Grypp InteractiveDocs supports form completion with legally binding signatures via GryppSign, including a full audit trail and timestamps, and instantly confirms customer identity through biometric scans with Sign by Selfie. Built for regulated industries such as finance, insurance, healthcare, and utilities, Grypp InteractiveDocs also features Know Your Customer (KYC) capabilities with enhanced verifications, to automatically recognize and verify document types either with or without Artificial Intelligence (AI) drivers according to your selected preferences.

Grypp InteractiveDocs

Real-time document viewing and co-completion with smart form fields including e-signatures, dropdowns, checkboxes, and free text.

GryppSign

Secure, legally compliant e-sign capture with audit trail and timestamps.

Sign by Selfie

Biometric identity verification using facial recognition

AI-Powered ID Verification

Leverages AI models to instantly recognize ID documents and extract structured data using Optical Character Recognition (OCR)

Handle Document and ID Verification Live and Move Through the Customer Journey Faster

Grypp InteractiveDocs enables your agents to complete document reviews, signature collection, and identity validation in real-time, virtually… alongside your customers. Validate identity and satisfy KYC quickly to enable fast, secure, and personalized customer onboarding from anywhere.

Reduce friction in onboarding

- e-sign documents and handle ID verification live in-session

- Eliminate back-and-forth from email-based document delays

Improve conversion rates

- Complete signups or purchases without dropout

- Reduce abandonment by removing manual, asynchronous steps

Secure, compliant, ready

- Meet KYC/AML, HIPAA, and GDPR standards

- Timestamped audit trails for each document interaction

Enhance security

- Built-in 512 point facial verification

- Automated spoof and liveness detection

How Grypp InteractiveDocs Work

By eliminating friction in ID verification, KYC checks, form completion and signature capture, Grypp InteractiveDocs streamlines the customer journey and enhances operational efficiency.

Grypp InteractiveDocs enables your agents to view and complete documents live with your customers – together, in real time. The process is simple: an agent launches a doc in any live visual engagement session with a customer, and the customer is prompted to complete the fields and sign live.

For ID verification, the agent initiates selfie validation to match the customer to the uploaded ID for an additional layer of verification security. The customer is then able to quickly and securely e-sign the document, which is saved with full traceability for full, uncompromised compliance.

Grypp is powerful on its own but integrating it with your existing software is fast and hassle-free. Our public API makes it easy to embed visual interactions directly into your existing solutions.

Easy to set-up with no installation or downloads needed. Whether your customers are using a computer, tablet, or mobile device, connect anywhere at any time with cross-device connectability, and simply click a link to start.

Our Customers are Already Achieving Impressive Results Including:

Reduction in AHT by reducing escalations with real-time clarity, through visual guidance instead of just merely explaining

Increase in CSAT by reducing friction for tech issues and complex online processes, and delivering remote service that feels face-to-face

Boost in conversions by reducing manual steps and completing signups or purchases live without drop-off

FCR Increase

Why Grypp?

Speed up document signing and identity verification without sacrificing security and compliance with Grypp’s ID verification platform.

Use seamlessly alongside any Grypp visual engagement session to handle e-signatures in real-time and empower your agents to serve customers like they’re standing right beside them.

- Biometric signature capabilities tied to identity - not just a scribble on a screen

- AI automatically reads ID types such as passports and licenses and OCR extracts data for verification

- Includes dynamic smart fields such as checkboxes, dropdowns, and text inputs

- No app, login, or download required for customers

- Full audit trail with timestamps for document edits, views, and signatures

Collect Secure e-Signatures and Streamline ID Verification with Grypp InteractiveDocs

- View and complete documents live with your customers - together, in real time

- Add intelligent form fields including e-sign, dropdowns, checkboxes, and free text

- Capture legally binding signatures using GryppSign with full audit trail and timestamps

- Use Sign by Selfie to confirm identity using biometric analysis, not just a scribble on a screen

- Includes built-in 512 point facial verification with spoof and liveness detection

- Validate identity documents instantly and extract key data fields with AI-powered KYC

- Eliminate back-and-forth with asynchronous signing platforms by resolving in a single visual interaction

- Add selfie likeness capture to match the person to the uploaded government ID for an additional layer of verification security

- Securely log all document interactions for compliance and regulatory requirements

ID Verification Form Filling Digital Signatures for Every Industry

Streamline KYC, enable fast customer onboarding, and eliminate slowdowns in customer interactions with secure document signing, biometric signature capture, and identity verification built for every industry.

Banking

Verify identity for KYC, fill forms and capture signatures for account openings, loan agreements, and compliance documentation.

Healthcare

Verify patient identity for onboarding, e-sign consent forms, and securely sign treatment or release documents.

Insurance

Secure policy sign-ups, claims processing, and maintain real-time KYC compliance with ease.

Property Management

Accelerate lease signings, tenant onboarding, and approvals with secure ID checks and digital signatures – reducing fraud and improving compliance.

Retail

Authenticate high-value transactions, verify age-restricted purchases, and capture delivery confirmations.

Technology & SaaS

Secure new user onboarding, verify identities for platform access, and digitally sign licensing or service agreements.

Telecom

Verify identity for account setup, authorize service changes, and sign contracts or consent forms.

Travel & Hospitality

Speed up check-ins, verify traveler ID, and sign rental or booking agreements digitally.

Utilities

Complete contract agreements, move-in forms, authorize service changes and ID verification digitally.

FAQs

How secure is the signature process?

Grypp’s signature process is designed with security and compliance at its core. Every interaction is securely logged, ensuring full traceability for regulatory and audit purposes. Each e-signature includes a detailed audit trail with timestamps and identity verification. The solution aligns with the core requirements of e-signature regulations such as eIDAS and ESIGN, supporting compliant workflows across multiple industries.

What identity documents are supported?

Grypp supports a wide range of government-issued identity documents, including driver’s licenses, ID cards, passports, and more. Our AI automatically detects and classifies the document type, ensuring a smooth and accurate verification process.

Can customers use this on mobile?

Grypp is designed with a mobile-first approach, ensuring a smooth and intuitive experience on any smartphone or tablet.

Is the signature legally binding?

Yes. GryppSign captures legally binding e-signatures by recording user intent, identity, and timestamped consent – all key requirements under major electronic signature laws such as eIDAS (EU/UK) and ESIGN (US). This ensures signatures are enforceable and auditable across a wide range of legal and regulatory contexts.

How does facial verification work?

Facial verification is powered by built-in 512 point facial verification, complete with spoof and liveness detection.

How does Sign by Selfie ensure biometric identity verification during a live session?

Sign by Selfie ensures biometric identity verification through a secure, real-time facial recognition process conducted during a live session. Here’s how it works:

- Live Capture: The customer is prompted to capture a live selfie using their device’s camera – this prevents the use of static or spoofed images.

- Facial Matching: The system compares the live selfie to a previously verified image, such as a photo extracted from a government-issued ID, using advanced facial recognition algorithms.

- Liveness Detection: Built-in liveness checks help confirm that the person is physically present and not using a photo, video, or mask. These checks can include subtle motion detection, blink verification, or texture analysis.

- On-the-Spot Verification: The entire process happens during a secure live session, and the facial match is verified in real-time, ensuring that the person signing is the same person whose identity has been validated.

- Audit Trail with Visual Evidence: Once the verification is successful, the selfie and key session metadata are securely stamped into a PDF document or digital record, creating an immutable audit trail for compliance and proof of identity.

What types of documents can be signed within the InteractiveDocs feature?

InteractiveDocs supports the signing of a wide range of document types typically used in customer interactions and operational workflows. These include:

- Agreements & Contracts: Service agreements, terms and conditions, consent forms, NDAs, and other contractual documents.

- Compliance Documents: KYC forms, policy acknowledgements, GDPR consents, and regulatory disclosures.

- Order Forms & Quotes: Purchase orders, sales quotes, subscription plans, or product configuration summaries

- Claims & Authorizations: Insurance claims, repair authorizations, or financial release forms

- Custom Workflows: Any document requiring digital signatures, tick-box confirmation, dropdown selections, or embedded guidance – tailored to match your customer journey.

All documents within InteractiveDocs are dynamic, meaning they can be partially prefilled, visually guided, and signed in real-time during a live session or asynchronously ensuring speed, accuracy, and compliance.

Can Grypp extract and validate fields from government-issued IDs automatically?

Yes! Grypp uses AI-powered KYC to validate government-issued identity documents instantly and OCR to extract key data fields.

What level of compliance does Grypp support for digital signatures and ID verification?

Grypp ensures robust compliance for digital signatures and identity verification by adhering to internationally recognized security and data protection standards.

Digital Signatures

Grypp’s digital signature solutions, including features like GryppSign and Sign by Selfie, are designed to meet stringent regulatory requirements. These solutions provide:

- Audit Trails: Comprehensive records of all interactions and transactions, ensuring transparency and accountability

- Biometric Verification: Integration of biometric data, such as facial recognition, to authenticate signers’ identities

- Real-Time Collaboration: Agents and customers can complete and sign documents together during live sessions, enhancing efficiency and accuracy

These features collectively support compliance with regulations like the EU’s eIDAS, particularly concerning Advanced Electronic Signatures (AES), which require a high level of signer authentication and data integrity.

Identity Verification

Grypp’s identity verification processes are aligned with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. Key aspects include:

- Real-Time ID Checks: Verification of government-issued IDs during live sessions, reducing the risk of fraud

- Facial Recognition and Liveness Detection: Ensuring the person presenting the ID is physically present and matches the ID photo

- Secure Data Handling: Adherence to data protection standards to safeguard personal information during the verification process

Security and Compliance Certifications

Grypp’s commitment to security and compliance is demonstrated through several certifications:

- ISO 27001: An international standard for information security management systems

- SOC 2 Type II: Certification indicating effective controls for data security, availability, and confidentiality

- GDPR Compliance: Ensuring data processing practices meet the European Union’s General Data Protection Regulation

- HIPAA Alignment: For clients in the healthcare sector, Grypp aligns with the Health Insurance Portability and Accountability Act standards to protect sensitive health information

- PCI DSS Compliance: Ensuring all payment interactions, whether via phone, chat, or digital channels are handled securely, protecting cardholder data and reducing risk in accordance with the Payment Card Industry Data Security Standard

How are signed and verified documents stored, and who has access to the audit trail?

Grypp acts as a secure, pass-through mechanism. All signed and verified documents are transferred to your CRM or designated system of record. During the process, documents are temporarily stored in encrypted private buckets, with access and retention policies fully controlled by your administrators.

- Secure Storage

- Documents are held temporarily in storage buckets with encryption at rest (AES-256) and server-side encryption managed by KMS (Key Management Service). Access is private, policy-restricted, and retention is set by your admin team.

- Access Control

- Only authorised company administrators and the individual customer may access stored documents. Access is role-based, securely authenticated, and fully audited to ensure complete accountability.

- Immutable Audit Trails

- Each signed document is linked to a tamper-proof audit trail that records timestamps, identities, and actions (e.g., viewed, signed). This trail is permanently attached and retrievable for compliance, dispute resolution, or legal review.

- PCI DSS Compliance

- We work with PCI compliant payment partners to ensure payment services comply with PCI DSS requirements, ensuring all payment interactions, whether via phone, chat, or digital channels are handled securely, protecting cardholder data and reducing risk.

In short, Grypp provides secure, compliant handling of all signed documents and audit data, from signature to storage, under strict, enterprise-grade governance.